Bitcoin Price: Future Of Crypto In Germany As The Country Enters Recession

Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin (BTC) price currently shares a similarity with Gold on value metrics, which explains why economists consider it a safe haven asset even in countries like Germany which has just entered a recession. The safe haven narrative started when the king crypto decoupled from the United States stock market indices earlier in the year. Nevertheless, BTC has been unable to share likeness with Gold in the area of ‘trust’.

It’s here. The 17th annual edition of In Gold We Trust, the leading in depth analysis of gold as a monetary asset, commodity, and store of wealth. Looks at de-dollarization, Bitcoin, and much more. The go-to report.https://t.co/iMxF4tzClD pic.twitter.com/rLDHoJM1Dr

— Jim Rickards (@JamesGRickards) May 25, 2023

Amid the lack of definite regulations in the United States and globally, crypto remains in its latent stages. As such, it could take a while longer to catch on even in economically constrained countries like Germany.

Germany Enters Recession After A Negative GDP Growth In Q4

Germany noted a decline in its economy in the first quarter (Q1) of 2023 after recording a negative GDP growth in Q4 2022. This contraction led the country into the official confirmation of a recession. Considering its influential position as the biggest economy in the European Union (EU), the impact of the news has caught up with the Euro, causing the EUR/USD pair to fall to a two-month low of $1.072. This has, in turn, benefitted the USD, and explains why the United States Dollar Index is rising. Notably, as of May 25, it had hit a two-month high of 104.31.

For the USD, this was positive news given the growing concerns about the United States debt ceiling. However, DXY over the month did not seem to exhibit any impact from these concerns as the index rose by more than 3% over the month.

#DXY

Dollar Index is in strong position now over 104 mark.It is going to stay there for a while due to Debt ceiling.In just one month it has gone from 101 to 104. As you can see here in the chart.

For daily updates, signals, analysis FOLLOW ME.#XAUUSD #forex #trading pic.twitter.com/gH1etwmToZ

— Noor (@Noor02730758) May 26, 2023

Moreover, the potential of reaching a settlement increased over the last few days as talks between the Biden administration and the Republicans commenced. Based on the virtual meeting on Thursday, both sides are open to compromise and could reach common ground to raise the debt ceiling.

Nevertheless, the ripples of the same bullish wave have not been felt on the crypto markets, with Bitcoin (BTC) price still moving within the Achilles heel of the 100-day SMA at $26,676.

Why Germany’s Situation Has Not Provoked A Reaction From Bitcoin Price And The Crypto Market

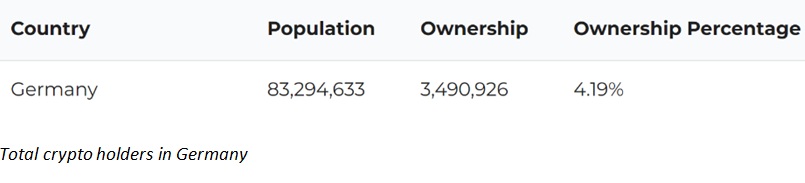

Although Germany is the biggest economy in the EU, news of its recession and the subsequent impact on the Euro has not excited a reaction from BTC. This is because only 4.9% of Germany’s entire population (83.2 million people) own crypto. To put this in perspective, the 3.4 million people making Germany’s crypto-owning demography are less than 50% of Russia’s 8.4 million crypto-owning population, yet the latter is a much smaller economy.

Notwithstanding, Germany’s position as a member state of the EU puts it under the regulatory umbrella of the Markets in Crypto-Assets (MiCA) legislation. MiCA is considered among the most forward crypto regulations in the world, because of the provisions it issues covering transaction-related transparency, disclosure, authorization, and supervision. This could inject some faith among market players concerning crypto now that the country faces a recession.

In the meantime, however, there has not been any impact on Bitcoin price or other altcoins in the crypto catalog. Similarly, there has not been any significant increase in trading volume among the top German crypto exchanges, like Pionex, ZenGo, and NAGA, among others, over the past 24 hours.

On the flip side, Bitcoin price slumped by over 3% on May 25, bringing the king crypto to a two-month low of around $26,490. Nevertheless, BTC is still trading above the 200-day Exponential Moving Average (EMA) marked at $24,994.

TradingView Chart: BTC/USDT 1-Day Chart

This 200-day EMA is a crucial support level, and a break below it could clear the path for a prolonged bearish pull among traders and investors, potentially kickstarting a sell-off.

BTC Alternative

Switch gaze from Bitcoin and consider WSM, the ticker for the Wall Street Memes ecosystem. The project is underway with its presale, boasting $121,480 USDT raised in collections thus far, out of the $500,000 target. Investors can acquire 1 WSM for $0.025 for early entrant discount before the next stage where the token will auction at $0.0253.

Wall St Bulls Ordinals are ready to mint on @MEonBTC in less than 24 hours! Only 420 pieces, on the 690k inscription block.

Don’t miss out on this epic opportunity to own a piece of history!

05/26/2023, 4:20 PM EST ⌛️ pic.twitter.com/M7mACUAEqG

— Wall St Bulls (@wallstbullsNFT) May 25, 2023

The project sprouts from a rather creative idea when Wall Street was challenged in the infamous GameStop fiasco of 2021. The legacy of those brave Wall Street Bets heroes endures until today.

Wall Street Memes is the product of that movement, touted as the ultimate manifestation of the internet’s victory over unbridled capitalism.

As Wall Street Memes tokenizes the movement, we cannot overlook Gordon Gekko’s comments -“Greed is good”- in the ‘80s, as he got rich off useless stocks.

Fast-forward to 2023 (30 years later) there are hundreds more ‘questionable’ meme coins that let ordinary people to also become rich.

Join the $WSM army here today and prove that greed is, indeed, very good.

Also Read:

AiDoge – New Meme to Earn Crypto

- Earn Crypto For Internet Memes

- First Presale Stage Open Now, CertiK Audited

- Generate Memes with AI Text Prompts

- Staking Rewards, Voting, Creator Benefits

Join Our Telegram channel to stay up to date on breaking news coverage